- #Steps of annuitized on financial calculators how to#

- #Steps of annuitized on financial calculators free#

> I assume you are talking about an annuity with a COLA.Timing is important in this. I found this article and read the comments, and thought I’d lend a hand. That said, I do not think that more people buying annuities would lead to a decrease in payouts. “If more and more people living longer and longer buy annuities in the future, will this be a disincentive for insurance companies to provide them on favorable terms to consumers?”Īs life expectancies increase, yes, payouts must decrease. Once you don’t think you can safely beat the return that you’d earn by delaying the annuity purchase, I’d go ahead and buy as much as you plan to. “Do you believe in laddering annuities or buying just one?”Īs to buying just one, I’d first caution to stay under the state-backed limit regardless of how you decide to time your purchase(s).Īs to when to buy, my approach would be that outlined in this post. Perhaps another reader can chime in with some good info? “Are there ways to shop around for annuities to get the best quotes?” I probably should have written in step 1, “Determine how much after tax income you will need from your investments.” Then step 2 should be “Find out how much it costs to buy an inflation-indexed single premium immediate fixed annuity that will guarantee you that much after tax income for the rest of your life.” Given the way annuities are taxed (as well as the fact that they can be purchased with tax-free money), it’s slightly more complicated than that. “I assume you mean pre-tax income, correct? SS and pensions directly reduce this amount. Step 1 is to calculate income necessary from investments. (And yes, I do recommend them as at least a part of the portfolio for most retirees, given that most people tend to under-save.) And as a result, annuities come up a lot more. Now, for whatever reason, I find my interest drawn toward the distribution stage. For the first year or so of this blog’s life, I focused primarily on the accumulation stage–probably just because that’s the stage I’m in, so it’s what I thought most about. Really I’m just writing about them more often. “You seem to be moving more and more towards recommending annuities.”

#Steps of annuitized on financial calculators free#

In jargon free English, this gem of a book nails the key issues." "Hands down the best overview of what it takes to truly retire that I've ever read.

#Steps of annuitized on financial calculators how to#

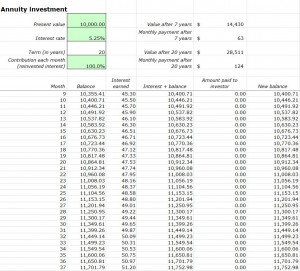

How to choose which accounts (Roth vs.How to minimize the risk of outliving your money,.How to calculate how much you’ll need saved before you can retire,.Retiring Soon? Pick Up a Copy of My Book:Ĭan I Retire? Managing a Retirement Portfolio Explained in 100 Pages or Less If your necessary withdrawal rate is low enough, you may not need to annuitize at all, as you’ll be able to get away with a typical stock/bond portfolio.Īnd finally, when it comes time to actually buy that annuity, you’ll want to a) look for insurance companies with strong financial ratings, and b) do your best to stay under the limit backed by your state’s guarantee association. Third, the more money you have in comparison to your necessary investment income–that is, the lower your necessary withdrawal rate–the less of your portfolio you’ll need to annuitize.

(Naturally, how much more you’ll need depends on how much you want to leave behind.) Second, if you want to leave something to your heirs, you need more. (In exchange, you give up the possibility of leaving the money to your heirs.) Reason being that with an annuity, you get a payout that is higher than could safely be taken from a typical portfolio of stocks/bonds/mutual funds. That said, it’s worth making a few related observations.įirst, you cannot safely retire on less money.

And, in my experience, most people assume that answering the question will involve a lengthy process of complicated calculations.

0 kommentar(er)

0 kommentar(er)